Investment philosophy

We focus on sustainable direct investments and have a strong weighting in Swiss investment stocks. Stability and performance are our guiding principles, quality and transparency are paramount: we prefer to invest rather than speculate.

Stability

- Own investment strategy focussing on Swiss assets

- Quality and transparency are in the foreground

- Focus on best risk-return ratio

Quality

- Quality over diversification

- Focus on direct investments in Switzerland

- Buy and hold investments with the highest quality and less fluctuation in value

Transparency

- Collective investments only if vehicles are transparent, ideally co-determination in the selection of investments

- Category mandates with professional asset managers

- Real estate and alternative investments selected and managed by the Investment Commission

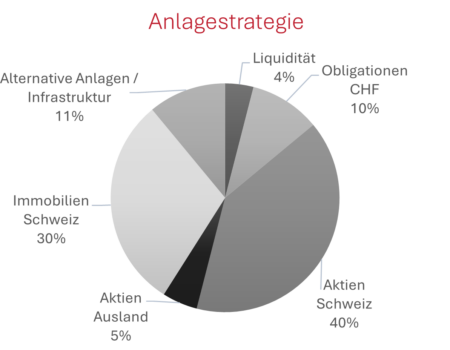

Investment strategy

The primary objective in capital management is long-term security in the increase of the retirement assets of the insured persons. In doing so, it is important to invest in the interests of the insured in order to be able to guarantee the promise of benefits in the event of old age, death and disability. Our investment strategy ensures that the financial balance of the Schweizer KMU Pensionskasse is strengthened in the long term.

Minimising risks

- Investment risks are consistently avoided if they are not compensated.

Sustainable stability

- The fluctuation risk is minimised through a real value-oriented investment strategy.

Prudent decisions

- Personal conviction and commitment of the Board of Trustees and Investment Committee.